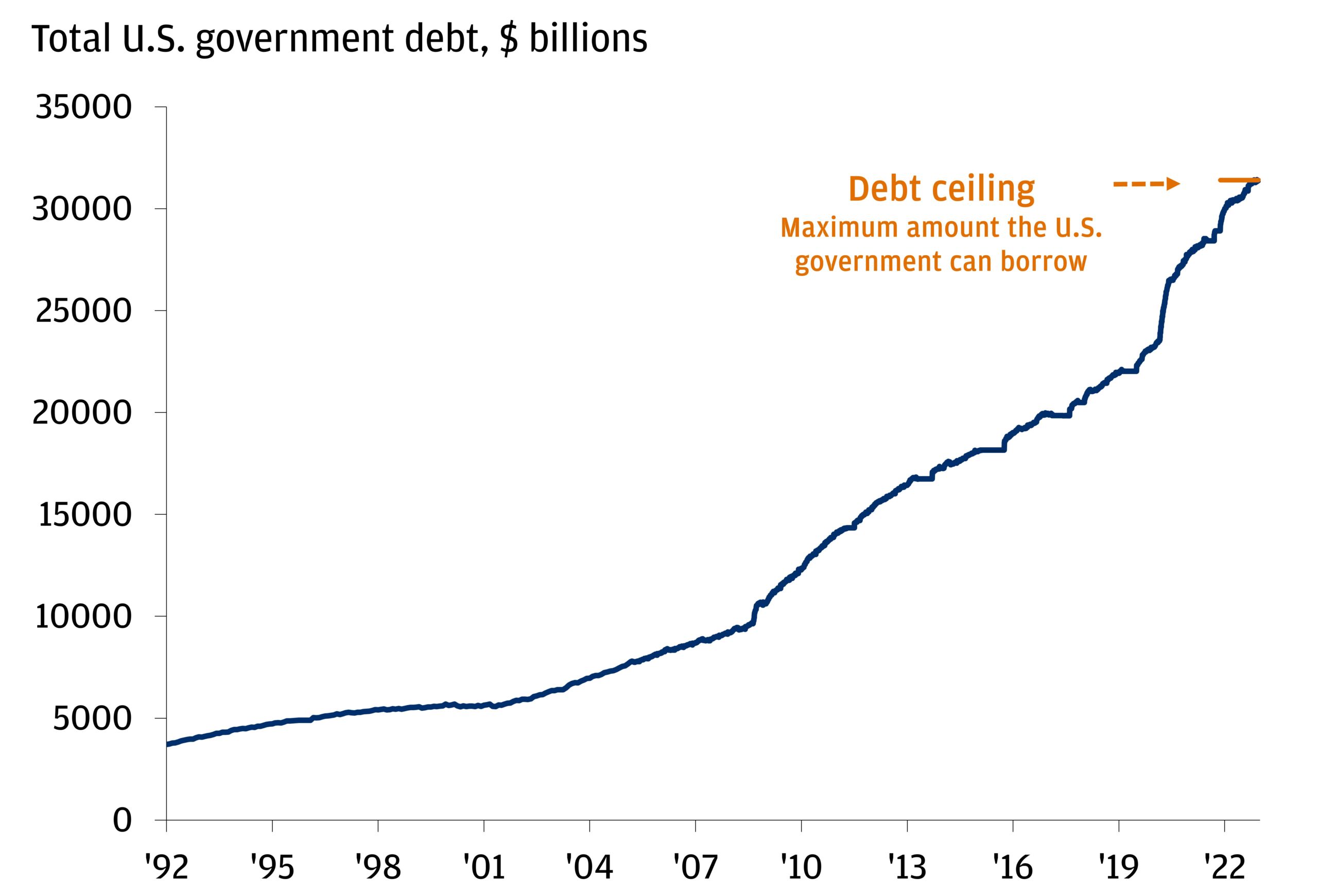

Destabilizing Debt

Standoff in Congress threatens markets; runaway spending poses tax risk

The U.S. government has again reached its statutory borrowing limit, commonly known as the “debt ceiling.” Extraordinary cash management measures by the Treasury Department allow the government to pay all its bills through early June (potentially even into Q3), at which point the world’s biggest economy could be at risk of failing to meet its obligations, including on its debt securities. This momentarily turns “safe” investing on it’s head, placing US treasuries and government bonds with a maturity date coinciding with a potential default at risk.

Beyond fixed income, the financial markets are already on edge regarding a potential downturn, and added uncertainty provides a perfect storm to push conditions “over the edge.” More broadly, if Congress becomes perpetually mired in stalemates on whether to meet it’s prior obligations, it will significantly damage the U.S. economy.

Source: Bloomberg Finance, Office of Management and Budget. Data as of January 16, 2023.

Future tax increases are likely. Roth Conversions can help.

Thinking about the debt ceiling negotiations more long-term, one can make no mistake: current runaway spending is unsustainable. Accordingly, a Roth Conversion eliminates the uncertainty of what income tax brackets will be in the years ahead (spoiler alert: likely higher than today to meet funding commitments for various entitlement programs). In fact, with the provisions of the Tax Cuts and Jobs Act of 2017 largely set to expire by 2026, these next few years are seen as an extremely opportune time to move money into a tax-free environment..

In addition to tax-free growth of your investments, a Roth conversion eliminates Required Minimum Distributions (RMDs). Your withdrawals from your portfolio in retirement are untaxed and not considered adjustable gross income, which means your Social Security benefit is untaxed, and Medicare premiums are eliminated or kept as low as possible. One can see how this has some cascading benefits.

As a Roth conversion causes a taxable event in the year (or years) of execution, we regularly receive information on special programs from law firms, CPAs,

consultants, and industry specialists and pair strategies. Special charitable projects fund a benefit to war torn, poverty stricken, or low income areas. They also create a significant charitable deduction, offsetting other gains and income.

Charitable projects vary year to year. More details are available upon request.

New Legislation, New Strategies, New Changes

Secure Act 2.0 has provided some new strategies, as well as changes:

529 as the new backdoor Roth. Families can make a tax-free rollover from 529 plans to Roth individual retirement accounts starting in 2024, making the 529 plan the “new back door Roth.” 529 funds are earmarked for education expenses like college tuition. Withdrawing money for a non-qualifying reason generally carries income taxes and a 10% tax penalty on investment earnings.

The 529-to-Roth conversion rule appears to be a rule with a “lifetime limit” of $35,000 that will apply “per beneficiary,” rather than “per account” or “per the converting taxpayer. Theoretically, an owner of a 529 account that holds more than $35,000 in unneeded assets could change the beneficiary multiple times and then do a series of rollovers out of the 529 plan that would sum to an amount greater than $35,000. Given the significant potential benefit through this workaround, Congress or the IRS will likely restrict this with clarifying rules.

Nonetheless, the 529-to-Roth strategy is still appealing. But whatever rollover amount is being considered, it is clear at this stage that the 529 account has to have existed for 15 years in order to qualify for this type of conversion. Given this 15-year requirement, clients may consider opening a 529 plan today with a nominal contribution (say, $50 or $100). That way they can get the 15-year clock started, even if they have to name themselves as the initial beneficiary.

Paying off student loans to capture retirement plan contributions. Starting in 2024, employers can extend their 401(k) match programs to include any payments an employee makes toward student debt. The matches function much the same way traditional 401(k) programs do, with the company depositing its contribution into the worker’s retirement account. Employers have the discretion whether to include this provision, which would benefit many medical residents and younger doctors at the start of their careers.

RMDs from Inherited IRAs likely to resume. Before 2019’s Secure Act, any heirs who inherited traditional IRAs could “stretch” the account’s tax-deferring power by basing the calculation of their RMD amounts. They could thus enjoy decades of tax-free asset appreciation that often would see the inherited account’s value grow substantially rather than shrink, thanks to the modest RMD payments. Under proposed IRS regulations issued earlier in 2022, most inherited IRA beneficiaries must instead fully draw down the account’s value over a 10-year period, and they must take required minimum distributions in years one through nine if the account owner died after their own required beginning date. The IRS published a notice later in 2022 essentially pausing this new rule, but is now preparing to finalize enforcement. it is likely that the IRS will release proposed regulations in the coming months, and that clients with inherited IRAs will indeed have to start drawing income from the accounts.

Quarterly review and 2023 planning meetings

We are wrapping up Q1 2023 client review meetings, and are also holding 2023 planning sessions for new clients.

Every year, advances in technology allow us, our industry providers, and affiliated professionals to improve our services to you.

In 2022 we have added “Calendly” software to our communications. You may now schedule calls, virtual meetings and in-person appointments from links provided in our emails or from our website:

Avoiding losses to unnecessary taxes and risk

Finally, markets continue to show instability and unpredictability. With this in mind, we continue to recommend financial structures that avoid losses to unnecessary taxes and risk, including:

- Leveraged tax-free life income that combines financial leverage and tax leverage

- Diversified, distribution-focused strategies in professionally managed investment portfolios;

- Roth conversions paired with special charitable projects to mitigate tax liability and maximize spendable income;

- Incentives to eliminate capital gains taxes; and

- Equity index strategies that participate in market gains without incurring losses

We will discuss these opportunities, along with premium refund disability as an initial risk protection measure, in upcoming client reviews and new client consultations.

Reach out and start your journey from less to more.

Physicians Financial Services is an independent financial services firm specializing in the unique financial needs of doctors and their families, as well as other productive individuals. A national practice, PFS has administrative offices in Omaha, Nebraska.

For over 30 years, our firm has helped successful physicians and dentists across the country maximize the efficiency, control, and safety of the conversion of their earnings into spendable savings.

Our five question loss test can identify how much of your earnings and savings are currently being lost to unnecessary taxes and risk.

Our eBook and webinar provide financial education on the structures that move you to financial independence and personal significance.

Our monthly e-Newsletter provides updates on the structures and strategies important to doctors.

Click the link below for a free consultation and free financial analysis.

If you are new to us, click here to schedule your free consultation and financial analysis.

For existing clients, please schedule your client review meeting with us here.

Sincerely,

Jeffrey Taxman, MBA

Principal

Physicians Financial Services

402.399.8820 (o) | 402.681.9007 (m)

402.397.9510 (f) | jtaxman@pfsfa.com

Online: www.pfsfa.com

Matthew Taub, JD

Associate

Physicians Financial Services

402.399.8820 x105 (o) | 531.375.5962 (d)

402.960.2571 (m) | mtaub@pfsfa.com

Online: www.pfsfa.com

Physicians Financial Services specializes in the unique financial needs of doctors and their families, as well as other productive individuals. A national practice, PFS has administrative offices in Omaha, Nebraska.

You Need Not Be a Doctor: we also work with other productive individuals with similar financial needs.

All information provided by Physicians Financial Services is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. Such information also is not and should not be deemed to be an offer to purchase or sell or a solicitation of an offer to purchase or sell, or a recommendation to purchase or sell any securities or other financial instruments. The content in this promotional literature is based on sources that are considered reliable. No guarantee is provided on its accuracy, correctness or completeness either express or implied. The information provided is purely of an indicative nature and is subject to change without notice at any time. The information provided does not confer any rights. The value of your investment may fluctuate. Results achieved in the past are no guarantee of future results. You must make your own independent decisions regarding any securities or other financial instruments mentioned herein. You are advised to seek professional advice as to the suitability or appropriateness of any products and their tax, accounting, legal or regulatory implications.

DOCTORS’ FINANCIAL EDUCATION. Financial Education Series. | © Copyright 2022 Physicians Financial Services. | Jeffrey L. Taxman, MBA, | PFS Consulting LLC | 1810 South 108th St., Omaha, NE 68144, jtaxman@pfsfa.com, 402.399.8820 (o), 402.397.9510 (f)