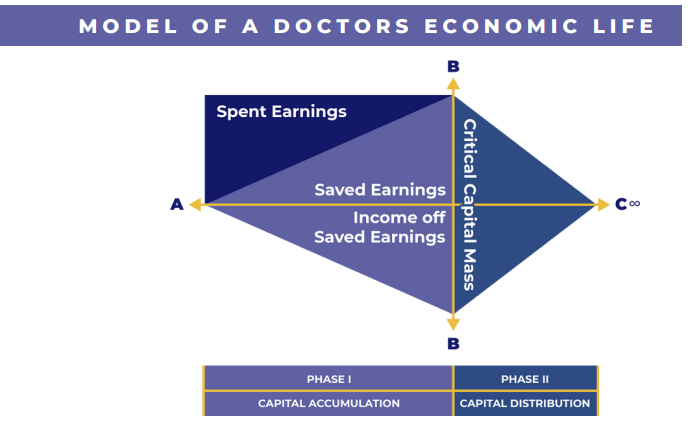

DOCTORS ECONOMIC LIFECYCLE MODEL

History of the Doctors Economic Research Project

Early findings indicated unique deficiencies in doctors’ educations regarding personal and business financial structures. Lack of time available in medical and dental school curricula prevented effective understanding of fundamental principles of business management and personal financial management. These deficiencies in economic education prevented doctors from controlling their practices and their personal financial structures.

This lack of control, in turn, contributed to stress related to uncertainties regarding basic business practices, personnel management, business cash flow, and allocations of capital and time. In addition, a lack of understanding of catastrophic loss and asset protection plans, qualified and non-qualified retirement plans, leverage, investment selection and investment objectives contributed to significant inefficiencies in the conversion of doctors’ surplus earnings to savings.

As a result of this demonstrated need the research project initially asked one fundamental question of doctors: What do you need to KNOW to succeed financially? Doctors’ answers to this question led to the development of graphic planning models depicting the economic life cycle of doctors and the priority allocation of doctors’ earnings during their careers.

These models provided the basis for the development of a unique economic education program for busy doctors. A second line of inquiry was developed based upon a frequent question from doctors who attended the economic education programs. The second question was: Would it be possible to quantify the planning models, planning principles, and planning rules of the economic education program in my personal financial circumstances?

A planning program was developed that quantified the economic education program’s planning models, planning principles, and planning rules in individual doctor’s circumstances.

A pilot project was initiated to develop a personalized capital accumulation plan that defined and quantified financial independence in an individual doctor’s circumstances, identified current lifestyle costs, assets and liabilities, retirement savings objectives, risk investment allocation percentages, losses to unnecessary income taxes, and progress toward financial independence.

The capital accumulation planning program was then made available to doctors who participated In the economic education program. Consultants were trained to implement the planning recommended by capital accumulation plans that were provided to thousands of doctors. A very high percentage of the doctors who implemented the planning recommendations achieved financial independence. The success of the accumulation planning program led to the development of personalized capital distribution plans and endowment creation plans.

A post-Great Recession iteration of the planning program, the New Economic Order Planning Program, began development in 2008 to meet doctors’ capital accumulation, capital distribution, and endowment creation requirements of a new economic environment of uncertainty and volatility. Pilot projects were initiated in 2012. After successful completion of the pilot projects the New Economic Order Planning Program became available for use by doctors in 2019.

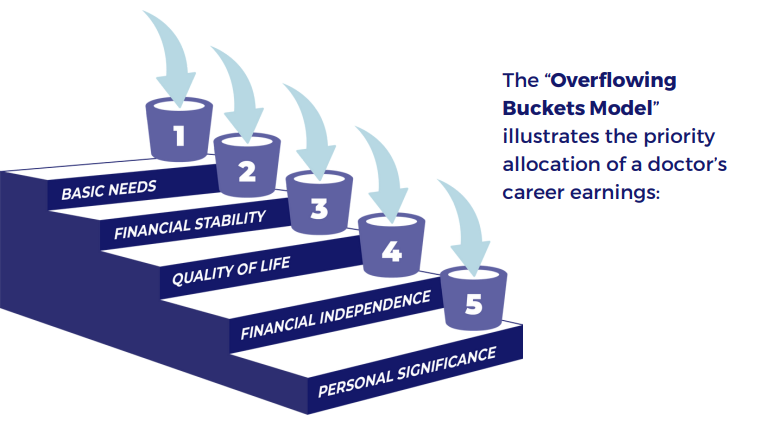

The “Overflowing Buckets” Model

The resulting program follows the “Overflowing Buckets” model to illustrate the priority allocation of a doctor’s career earnings. The allocation buckets, which flow chronologically, are as follows:

Bucket Two: Financial Stability