PHILOSOPHY

Our philosophy is based on findings from the Doctors Economic Research Project, a specialized area of inquiry that evolved from a privately funded research project initiated in 1971 to study the economics of productive individuals’ lives.

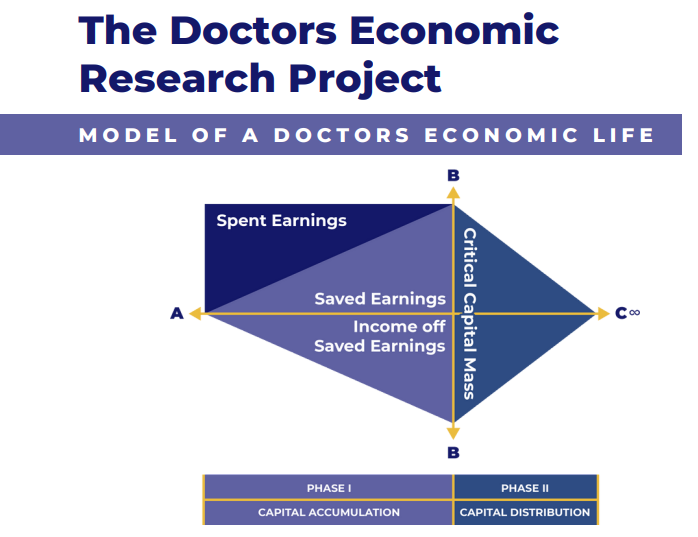

Model of a Doctor’s Economic Life

Developed from the project’s research, the Model of a Doctors Economic Life begins at Point A, when the Doctor earns more than he/she spends on lifestyle. Pont B is the achievement of Critical Capital Mass (sufficient guaranteed lifetime income to fund the Lifestyle of the Doctor and his/her Spouse). Point C is when the Doctor is dead.

Accumulation Phase: The period from Point A to B is the Accumulation Phase. Structures is the Accumulation Phase maximize the efficiency, control, and safety of the conversion of the Doctors earnings to spendable savings.

Distribution Phase: The period from Point B to C is the Distribution Phase. Strategies in the Distribution Phase maximize the efficiency, control, and safety of the conversion of savings to spending and gifting.

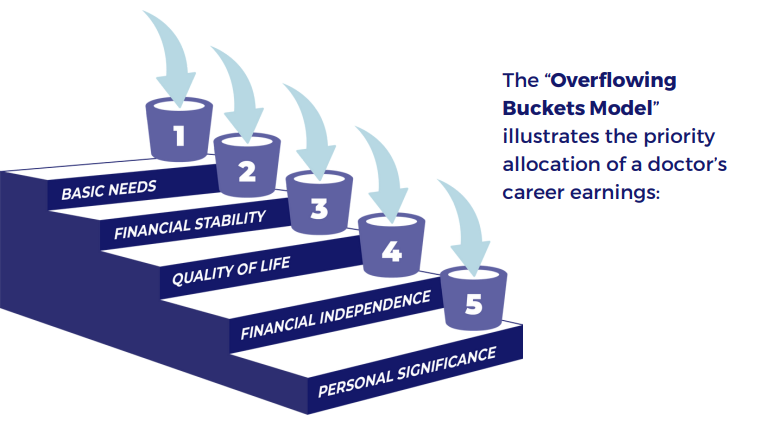

The “Overflowing Buckets Model” illustrates the priority allocation of a doctor’s career earnings.

Bucket One is the allocation of earnings to basic needs. Food, rent, gas, debt, smart phone, etc.

Bucket Two is financial stability . This includes protection of your earnings from catastrophic loss due to disability, early death and critical or terminal illness.

Earnings in Bucket Two are allocated to three to six months of lifestyle costs in a savings account as an emergency fund, life insurance, disability income insurance, long-term care insurance (unique properties and tax treatment also qualifying the latter for Bucket Five).

Bucket Three is quality of life. These earnings fund the lifestyle the doctor and his/her family desire. We want the doctor to be able to go into practice every day ready to face non-compliant patients, surly staff, uncooperative hospitals, insurance companies second-guessing protocols, and all the challenges of running a practice, knowing there is a quality of life in their personal and financial affairs that makes it all worth it.

Many Doctors do not surpass Bucket Three, but still live out wonderful lives.

Bucket Four is financial independence. This is when earnings fund critical capital mass. CCM is sufficient guaranteed assets to fund your lifestyle for your lifetime. The strategies implemented at this stage maximize the efficiency, control, and safety of the conversion of earnings to spendable savings based on not losing unnecessary earnings to income tax, or excessive risk.

Bucket Five is personal significance. Personal significance is achieved by giving something to somebody else. Earnings in Bucket Five are allocated to fund specialty designed long-term care contracts, which allow the doctor to fund up to $3m with non-taxed compensation, ultimately funding a permanent endowment.

One component of Bucket Five planning is the permanent endowment program. It administers funding for 501(c)(3) nonprofit organizations that support values important to the doctor and society.

How do I reach Bucket Four or Five?

Your economic landscape may currently be pulling you in multiple directions, with little collaboration or coordination. Bankers, lawyers, insurance agents, CPAs, and financial advisors may all be prioritizing their area of expertise with little regard for the “big picture” of achieving financial independence and personal significance. In contrast, our clients end up with all of these services executed on a coordinated basis in order to achieve their financial goals.

Contact us today to schedule a free consultation to find out how to achieve your goals.