Supercharge your retirement

The leveraged, tax-free life income program (LT-FLIP) supercharges growth.

The Leveraged Tax Free Life Income Program (LT-FLIP) generates 200% to 300% more spendable retirement distributions for half the cost in half the time.

A bank or other lender contributes three quarters of the contributions, and is paid back from the growth of the account later on.

The LT-FLIP is a special design, nonqualified retirement plan that accelerates the growth on 5 years of plan contributions through leverage that equals 300% of the participants’ contributions to the plan.

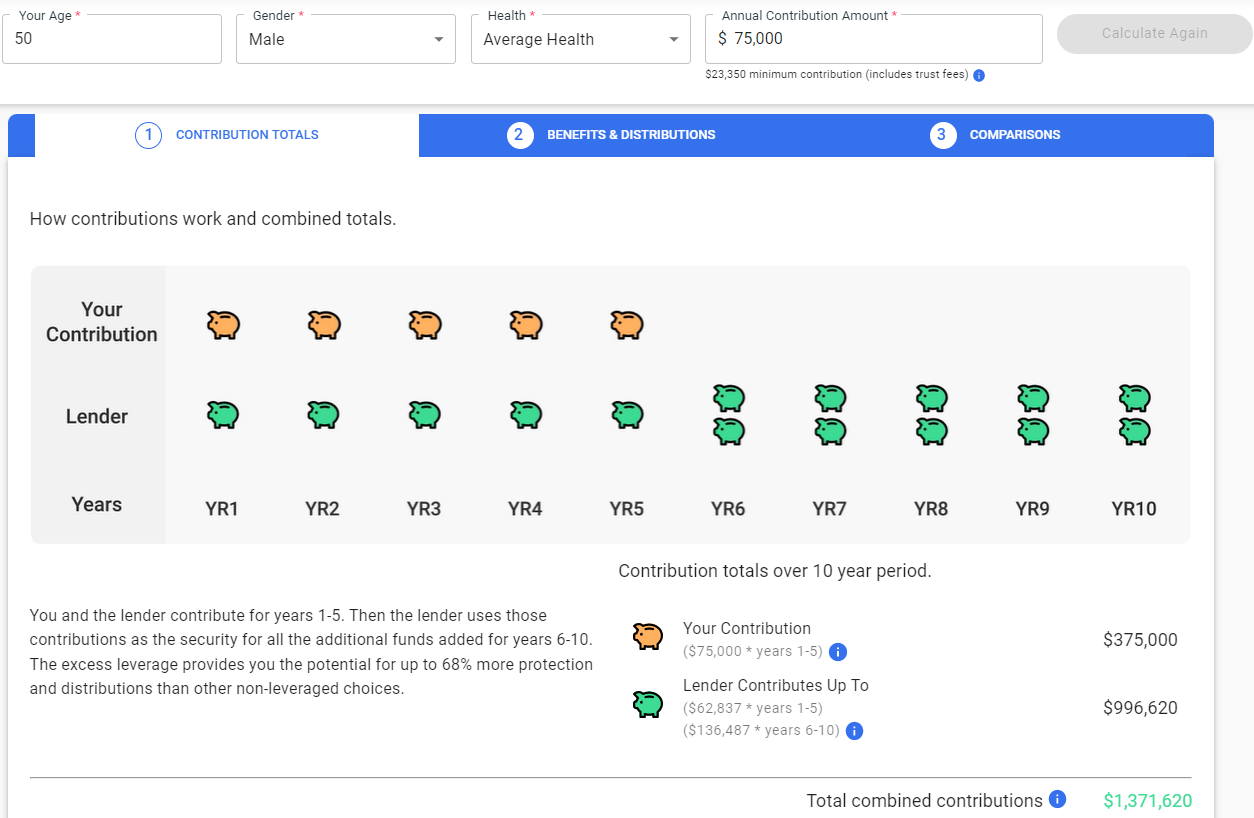

Clients can estimate their benefits based on their age, health, and annual contributions of $22,000 – $100,000 per year for five years.

For the first five years, a participant’s annual contributions to the plan are matched by lenders’ funds. During the second five years of the plan (years 6 through 10), the plan participant makes NO more contributions. The lender contributes 200% of the participants’ annual plan contribution during this time.

At the end of the 10-year period, the lender has contributed $3 to the plan to each $1 from the participant. Contributions continue to grow untaxed.

Custom illustrations are now available. An example is as follows:

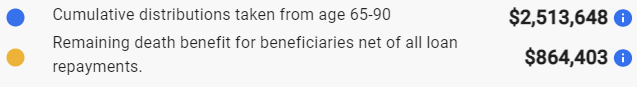

The LT-FLIP illustrations will show the projected accumulation available to spend, tax-free, in retirement:

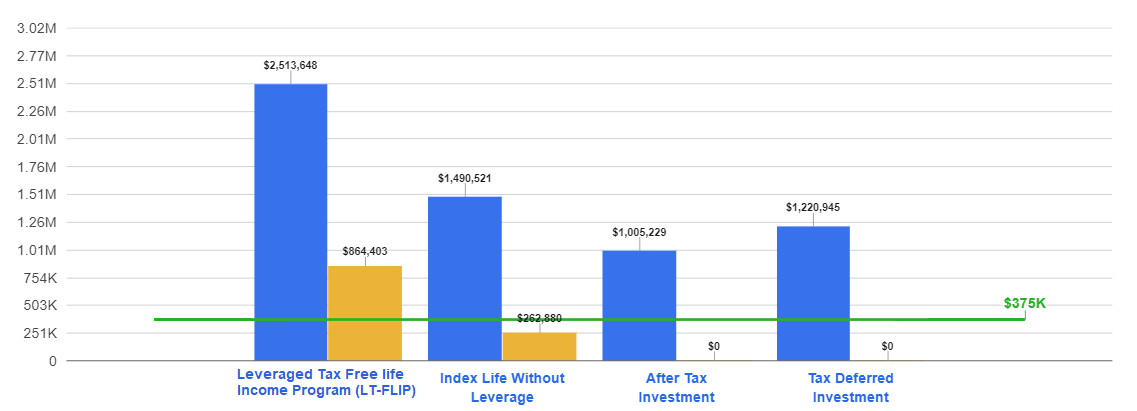

As well as a comparison to other investment vehicles with the client’s cash outlay as the benchmark ($375k in this case):

If a plan participant contributed $100,000, annually for the first 5 years ($500,000), the lender would contribute $1,500,000. In other words, the plan participant contributes 25% and the lender contributes 75% of the plan funding. The total plan contributions of $2,000,000 grow, tax-free, within the plan for the following 5-year period (years 10-15 of the plan).

At the end of the 15th year, a portion of the accumulated cash within the plan is allocated to repay the lender. The difference between the cost of the loan and the earnings credited on the participants’ and the lenders’ cash contributions to the plan allows participants to substantially multiply their retirement savings.

The lenders’ plan contributions are 100% collateralized by the cash accumulations within the plan. No personal guarantee or collateral assignment is required of the plan participant. Plan participants would not otherwise be able to obtain the $1,500,000 of leverage with no personal guarantee or assignment of collateral.

Summary of Leveraged Tax-free Life Income Program (LT-FLIP) Benefits

• Only 5 annual contributions

• Personal ownership and control

• No employer sponsor / control

• No losses of earnings to other plan participants

• Maximizes money-in/money-out efficiency compared to 401(k) and Defined Benefit Pension Plans

• Guaranteed outcome

• Guaranteed principal

• Untaxed income

• Protection from catastrophic loss protection and critical, chronic, or terminal illness.

• Tax-free growth on contributions

• Leverage that is otherwise inaccessible without personal guarantees or assignment of personal collateral

• Tax-free life income age 65 – 90

• No public plan tax return disclosures (no 5500 / annual filings)

• No compensation-based annual contribution limits

• Tax-free endowment creation for family members and/or for charities equal to the plan’s spendable retirement.

The amount of the leverage available is limited only by the plan participants’ annual plan contributions. Personal bank savings and risk investment portfolios of mutual funds and stocks and bonds can be repositioned within the plan to generate exponentially larger guaranteed life income than would otherwise be generated.

To run your own custom illustration, contact us for access.

Schedule a Consultation

For a more comprehensive assessment of how the LT-FLIP fits with your overall financial plan, you can now schedule your initial consultation or client review meeting with us electronically.

For over 30 years, our firm has helped successful physicians and dentists (as well as other productive individuals) across the country maximize the efficiency, control, and safety of the conversion of their earnings into spendable savings.

We look forward to visiting with you.

Sincerely,

Jeffrey Taxman, MBA

Principal

Physicians Financial Services

402.399.8820 (o) | 402.681.9007 (m)

402.397.9510 (f) | jtaxman@pfsfa.com

Online: www.pfsfa.com

Matthew Taub, JD

Associate

Physicians Financial Services

402.399.8820 x105 (o) | 531.375.5962 (d)

402.960.2571 (m) | mtaub@pfsfa.com

Online: www.pfsfa.com

Physicians Financial Services specializes in the unique financial needs of doctors and their families, as well as other productive individuals. A national practice, PFS has administrative offices in Omaha, Nebraska.

You Need Not Be a Doctor: we also work with other productive individuals with similar financial needs.

Frequently Asked Questions about the Leveraged Tax Free Life Income Program (LT-FLIP)

Can you walk me through some of the ins-and-outs of this program?

We are happy to do so if you select a time to meet with us here. You can also listen to this recent podcast, where Jeffrey Taxman was a guest on Medical Justice, a medical advocacy service for healthcare professionals, explaining this program:

How is my money invested?

Your contributions and the contributions from the financing institution contribute to a specially-designed, equity-indexed life insurance contract.

Is my money subject to the volatility of the market?

No. The equity-indexed strategies in the contract do not lose money in down markets.

What is the projected rate of return?

The performance depends on your age at inception, your health at inception, the favorable tax treatment of the program, and the long-term performance of the markets. Request an invitation to estimate your benefits and your potential performance.

How will I know how my policy is performing?

You will receive an annual review and policy statement from the plan administrator. The review will contain information about the policy performance and amount of interest credited to the policy – along with the outstanding loan balance and current interest rates of the loan.

Why are banks and other lenders willing to invest in my financial future?

Legal reserve life insurance companies are very safe custodians of money. Financial institutions are very comfortable making loans at competitive rates collateralized by life insurance contracts.

Can I have a say in how the money is invested?

Yes. Physicians Financial Services will help you select the strategy for highest return for risk assumed in the contract. However, this is not a risk portfolio — no individual stocks, bonds, or mutual funds are selected.

Is the program best understood as a life insurance policy, annuity, or retirement plan?

It depends on the purpose. The LT-FLIP is commonly used as a extremely tax-efficient accumulation strategy, supercharging wealth accumulation to be withdrawn in retirement. But it is also the most efficient way to fund death benefit. It is not an annuity contract.

Why does the program use a life insurance policy?

Life insurance contracts enjoy very favorable tax treatment. Adding leverage (money from lenders) to a life insurance contract puts more money to work in the specially-designed, equity index insurance policy. Growth of assets inside an equity-indexed insurance policy are untaxed, and distributions can be received untaxed.

Is the money invested deductible or tax-deferred?

Premiums paid by you are paid with after-tax dollars. Premiums paid by the bank or other lender are not taxed.

Is the money’s growth tax free? Are withdrawals tax-free?

Growth of assets inside an equity-indexed insurance policy are untaxed, and distributions can be received untaxed.

When will I be able to access the income in the plan?

Normally the designs require you to wait until you are 65 or older to start accessing income, when you are retired and need it most. However, the loan is scheduled to be paid off in year 15, so technically after year 15 a participant will have tax-free access to the cash in their policy via policy loans.

The exact amount of income will depend on the performance of the product over time. The combination of lender matching, downside protection on the Indexed Universal Life policy (0% floor), and the tax advantages will all help determine the amount of income you can receive.

What companies are involved in the investment and management of my money?

Larger, legal reserve insurance companies rated A+ or better by major ratings agencies. Examples of eligible companies for this program are Pacific Life Insurance Co., National Life Insurance Co., and Allianz Insurance Co. Depending on your premium outlay, we are able to arrange for you to have a conversation with senior executives of these companies directly as you contemplate one of these structures.

Do my five annual payments need to be the same amount each time?

A participant in the program must commit to at least five years of level contributions.

Can I contribute for more or less than five years?

The plan can be designed to be funded by you for five years or more. It must be at least five years.

What happens if I cannot make a payment in the second, third, fourth, or fifth year?

It is imperative that the program is designed around a sustainable yearly payment from the participant. If the annual contribution cannot be made, the lender will call your portion of the loan and take the remaining loan amount out of the cash value of your policy. The cash value will be used to repay the loan or surrender the policy in full, and then the trustee will refund the remaining funds (minus any trustee or admin fess) directly to the participant. If a withdrawal from the cash value of the policy can be made to retire the loan, you can still maintain your policy and make premium payments as necessary.

If a subsequent payment cannot be made due to death or the inability to conduct two of six activities of daily living, the death benefit from the program would be paid.

What are the risks with this program?

The strategy has been stress tested based on historic economic volatility and maintains positive returns.

If you are unable to commit to five years of payments, this is not a suitable program.

Why does the LT-FLIP sound “too good to be true”?

One of our biggest challenges is hearing that the LT-FLIP sounds “too good to be true.”

The LT-FLIP is made up of an Index Universal Life policy and a safe bank loan that conforms to all the regulatory requirements the banks need to conduct normal loan structures.

The Index Universal Life insurance policy is an attractive asset for banks to finance because it accumulates cash value over time. The LT-FLIP is designed specifically so that the cash value secures the bank loan without personal guarantees.

The LT-FLIP design performs stress tests to account for worst case scenarios, meaning that the loan is still secured by the cash value in the policy even in a highly volatile market such as a recession or depression.

The LT-FLIP is structured where each policy is ring fenced and asset protected, which protects the lender’s loan from outside threats.

Why have I never heard of this product before?

Using leverage to buy life insurance is common with very wealthy families, because it allows individuals to afford more of the protections they need while maintaining their liquidity. Instead of relying on one wealthy family, the LT-FLIP achieves the same results by pooling the funds of groups of individuals.

So, although this is a new offering outside of the ultra-high net worth market, the practice of premium finance is something that has been used by the wealthy for decades. When structured this way, it is extremely unlikely for the lenders to lose their money. Thus, it is an attractive investment for them.

What are the benefits of this program?

No personal guarantee or collateral assignment is required of the plan participant. Plan participants are not otherwise be able to obtain this amount of leverage, supercharging their retirement without market risk, with no personal guarantee or assignment of collateral.

You may estimate your specific benefits with your invitation to access the program. Contact us to get started.

Can I craft multiple proposals and review them? Is there a time limit to act?

Once you contact us, we will grant you access to a portal where you can input your personal demographics and desired level of funding. You can craft multiple proposals at different funding levels to review, and there is no time limit to act.

We are happy to meet with you if you have questions, or if you would like a consultation to ensure your selection is suitable and fits with your overall financial plan.

Is the LT-FLIP available to successful individuals who are not currently residing in the United States?

Yes. There are solutions for non-US residents and non-US citizens to access and benefit from this structure. Contact us for details.

Further resources from Physicians Financial Services

Download our free E-book

A study of the economics of productive individuals’ lives focused on one question: what do you need to KNOW to succeed financially? A planning program was developed and a high percentage of those who implemented the planning recommendations ultimately achieved financial independence. DOWNLOAD E-BOOK>

Take the Loss Test

The Economic “Loss Test” is a diagnostic tool to assess your current financial structure, identifying opportunities. TAKE THE TEST>

Watch Our Webinar

The “Overflowing Buckets” guide to End Losses to Unnecessary Taxes and Risk. Based on the 50-year Doctors Economic Research Project. WATCH WEBINAR>

Schedule Your Meeting

An initial phone or zoom meeting can be scheduled electronically at no cost and with no obligation. SCHEDULE NOW>

We look forward to helping you.

Comparative Analysis of Retirement Plan Options

The following analysis compares the spendable 25-year retirement distributions from maximum-funded qualified retirement plans (401(k) Plans and Defined Benefit Pension Plans) to the spendable 25-year retirement distributions generated from the non- qualified retirement plan, the Leveraged Tax-free Life Income Program (LT-FLIP), with participants beginning their funding of the plans at ages 25 through age 55. Annual 401(k) Plan contributions are currently limited to the lesser of 25% of salary or $57,000. A maximum, $57,000 annual contribution to a 401(k) Plan requires an annual salary for the plan participant of $228,000 (25% of $228,000 equals $57,000) and annual employer net income of $285,000 ($228,000 plus $57,000 equals $285,000).

Annual Defined Benefit Pension contributions are currently limited to the amount of annual savings required to accumulate $2,800,000 at the participant’s age 65, assuming that the participant had average annual earnings for 3 years of $225,000 from the employer sponsoring the plan, and, that the participant is married. If a plan participant is single, the maximum accumulation at the participant’s normal retirement age 65, assuming the $225,000 average annual compensation for three years, is $1,400,000.

If a participant was single and had $112,500 average annual compensation for three years the savings accumulation limit, at normal retirement age 65, is $700,000. For the purposes of the comparative analysis, maximum annual contributions were assumed for both the 401(k) Plan and for the Defined Benefit Pension Plan. Annual employer earnings of $285,000 were required to fund the maximum, $57,000 annual contributions for the funding years of the 401(k) Plan through the participant’s age 65.

Annual employer earnings of $225,000 were required for the 10-year period to fund the Defined Benefit Pension Plan. Annual personal compensation of $167,000 is required for 5 years, a total of $865,000, to fund the 5 years of $100,000 annual contributions to the Leveraged Tax-free Life Income Program, and to fund the participant’s 40% tax loss on the personal earnings required to generate the $100,000 annual contributions.

Although employer earnings are usually lost to other-employee costs of 401(k) Plans and Defined Benefit Pension Plans, which reduces spendable distributions at retirement age, an assumption was made for the comparative analysis that there were “0” annual other-employee costs incurred by the employer for the 401(k) Plans and Defined Benefit Pension Plans.

In addition, although qualified retirement plans incur fees and annual tax preparation costs, an assumption was made for the comparative analysis that there were “0” plan set-up fees and “0” plan annual administration costs to file annual tax returns incurred by the employer for the illustrated 401(k) Plans and Defined Benefit Pension Plans. A growth rate on plan savings of 4% was assumed for the 401(k) Plan, the Defined Benefit Pension Plan, and the Leveraged Tax-free Life Income Plan.

A 40% tax loss was assumed on retirement distributions from the 401(k) Plan and from the Defined Benefit Pension Plan. Tax losses on retirement distributions from the Leveraged Tax- free Life Income Plan were assumed to be “0” because the plan has an annual contribution pattern that qualifies the plan as a non-modified endowment contract under IRC 7702(a), which provides for tax-free policy loans.

Background on Retirement Plans

There are two types of retirement plans, qualified retirement plans and non- qualified retirement plans.

Qualified retirement plans are funded with deductible, tax-free, earned income under a section of the Internal Revenue Code, IRC §401. Earnings on qualified retirement plan contributions accumulate with no current losses to income taxes under another section of the Internal Revenue Code, IRC §501. Accumulations of qualified retirement plan contributions and earnings on those contributions are taxable to the plan participant when distributed after a participant’s age 59 ½. Qualified retirement plan distributions prior to a participant’s age 59 ½ are subject to losses to income taxes plus an additional loss to an excise tax of 10% of distributions.

Non-qualified retirement plans are usually funded with non-deductible, taxable earned income. An exception to this “rule” was created by the 2017 Jobs and Tax Relief Act. Income to owners of pass-through businesses such as “S” tax status corporations and partnerships can fund nonqualified retirement plans with deductible, tax-free earned income under another section of the Internal Revenue Code, IRC §199 (a) that was a provision of the Jobs and Tax Relief Act of 2017. IRC §199(a) identifies tax-free compensation equal to 20% of an owner’s W-2 compensation of $315,000, if married filing a joint tax return, and $157,500, if single.

This deduction generates tax-free compensation of up to a maximum of $63,000, if married and filing a joint tax return, and $31,500, if single. The 199(a) tax-free compensation can be allocated to fund a non-qualified retirement plan. The question of whether earnings on non-qualified retirement plan contributions are subject to current or future losses to income taxes is determined by the design of the non- qualified retirement plan and the financial instrument to which the contributions are allocated. For example, a portion of the growth on allocations to non-qualified retirement plan would not be lost to income taxes if the financial instruments receiving the allocations were tax exempt bonds or whole life insurance.

Unlike qualified retirement plans, non- qualified retirement plans funded, in part, or totally, with tax-free compensation that is contributed to whole life insurance contracts can be structured so that the accumulations of non-qualified retirement plan contributions and earnings on these contributions are not taxable to the plan participant when distributed. These tax- free distributions can be used by plan participants to fund costs of preretirement critical, chronic, or terminal illness and lifestyle costs during retirement. An internal Revenue Code Section, IRC Code §7702A defines whole life insurance that receives no more than 70% of the total contributions in the first three years of the contract as “non-modified endowment contracts” that qualify to distribute accumulated funds as accelerated death benefits or as loans to plan participants that are not subject to income tax losses. IRC Code 101(a) enables accumulated loans to be repaid to an insurance company with tax-free mortality gain upon the death of the plan participant-insured.

The LT-FLIP is a special design, nonqualified retirement plan that accelerates the growth on 5 years of plan contributions through leverage that equals 300% of the participants’ contributions to the plan.

There a 4 Simple Requirements:

• Commit to 5 annual plan contributions ($100,000/year, or minimum annual contribution of $20,000/year, for 5 years).

• Provide proof of good health that is required to qualify for participation and maximize plan efficiency.

• Provide proof of annual household earned income of $100,000, or more.

• Complete required plan documents.

Disclaimer

All information provided by Physicians Financial Services is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. Such information also is not and should not be deemed to be an offer to purchase or sell or a solicitation of an offer to purchase or sell, or a recommendation to purchase or sell any securities or other financial instruments. The content in this promotional literature is based on sources that are considered reliable. No guarantee is provided on its accuracy, correctness or completeness either express or implied. The information provided is purely of an indicative nature and is subject to change without notice at any time. The information provided does not confer any rights. The value of your investment may fluctuate. Results achieved in the past are no guarantee of future results. You must make your own independent decisions regarding any securities or other financial instruments mentioned herein. You are advised to seek professional advice as to the suitability or appropriateness of any products and their tax, accounting, legal or regulatory implications.

DOCTORS’ FINANCIAL EDUCATION. Financial Education Series. | © Copyright 2022 Physicians Financial Services. | Jeffrey L. Taxman, MBA, | PFS Consulting LLC | 1810 South 108th St., Omaha, NE 68144, jtaxman@pfsfa.com, 402.399.8820 (o), 402.397.9510 (f)