Budget spreadsheet and basic first financial steps.

Here are some financial planning basics anyone can use to get started.

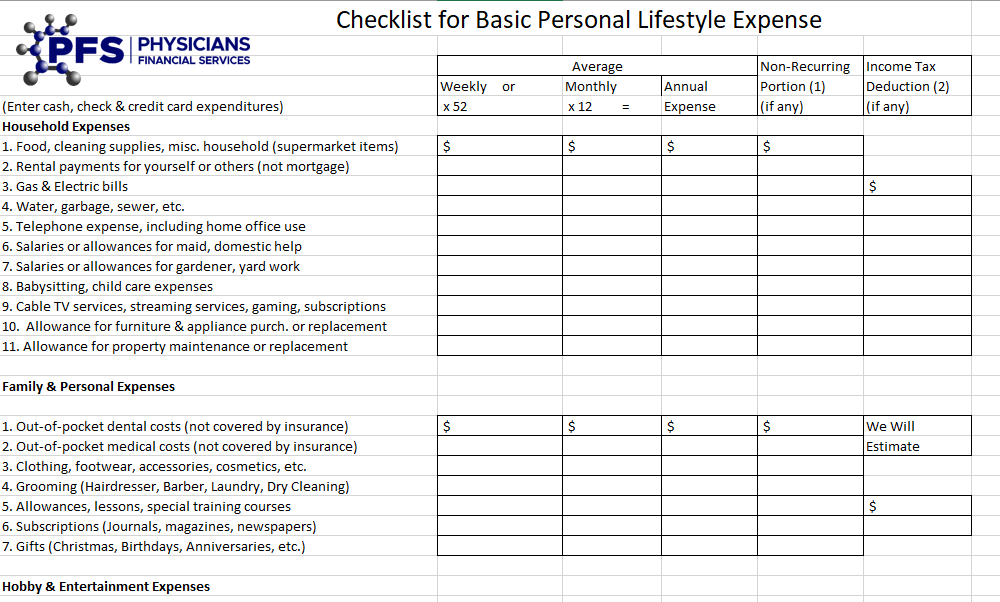

Initial Budgeting

- Do a budget to determine what your surplus monthly income is.

- Here is a budget spreadsheet. The data fields tally up, which is nice.

- Establish positive cash flow month to month by budgeting appropriately.

- Clear away all credit card debt and personal debts other than a mortgage and student loans subject to a repayment plan.

- Save 3-6 months living expenses in a checking or high-yield savings account.

Basic Risk Protection

Obtain supplemental disability income insurance and term life insurance from a reputable carrier with a good claims paying reputation.

- Supplemental disability insurance should be non-cancelable, guaranteed renewable, covering your own occupation / specialty with premium refunded every 10 years if you can get it.

- Term life should cover your salary and expected increases to at least age 65, the mortgage and other final expenses. You can obtain this online in minutes without a medical exam.

- Our firm can help you source and secure these two protections you need, without upselling you additional products that don’t fit in your budget now, and that you don’t need at this stage (or perhaps ever). You can also go to a number of marketplaces online and review different policies and carriers, but it might make sense to reach out at this stage.

Basic Investment Strategy

- Contribute to your 401k at least up to the match or other employer contribution available.

- Fund a Roth IRA to the max ($6,500/yr) or a traditional IRA if you are Roth ineligible.*

- Back to the 401k, fund it more if you can. $22,500 is the annual limit for 2023.

*Roth ineligible = Married joint filers with more than $228,000 in adjustable gross income (AGI), or single filers earning more than $153,000 AGI (2023 limits). In such a scenario, a “backdoor roth” is another possibility. Some 401k plans also offer a “mega backdoor roth.” Ask your 401k provider what Roth options are available within the 401k plan.

Advanced Planning With Tax-Optimized Financial Structures

If you have achieved all these steps, congratulations.

Now let’s chart a plan to eventually maximize wealth accumulation over the course of your working life and avoid losses to unnecessary taxes and unnecessary risk.

Strategies to keep your eye on from here include:

- Captive Insurance Companies

- Specialized Trusts and LLCs

- Leveraged Tax Free Life Income Program

- Capital Gains Tax Management

- Value system endowment

- Qualified Opportunity Zones

- Delaware Statutory Trusts

- Estate structure

- Economic Safety Nets

- Permanent Endowments

- § 7702B Endowment Funding

- Income Protection

- Defined benefit pension plans

- Cash Balance Plan

- Money Purchase Plan

- Profit sharing plan

- Elective deferral 401(k)

- Combination Qualified Plans

- Tax Reduction

- Indexed Structured Settlements

- Donor Advised Funds

- Supporting Organizations

- Community Foundations

- Private Foundations

- Special Charitable Projects

How to Select an Advisor

It is best to realize now that, as you achieve career success, everyone and anyone in your geographic and personal circles will approach you, asking to be your financial advisor.

- The best remedy for this is to already have someone you are working with that has clearly explained what protections you need, while not constantly upselling you.

- Our firm can do this, as well as provide free financial education. We will secure basic risk protection while explaining financial structures that, though currently aspirational, would be part of an overall financial plan. These structures will be implemented later, as certain career and financial benchmarks are met.

Schedule a Consultation

For over 30 years, our firm has helped successful physicians and dentists (as well as other productive individuals) across the country maximize the efficiency, control, and safety of the conversion of their earnings into spendable savings.

Our five question loss test can identify how much of your earnings and savings are currently being lost to unnecessary taxes and risk.

Our eBook and webinar provide financial education on the structures that move you to financial independence and personal significance.

Our monthly eNewsletter provides updates on the structures and strategies important to doctors.

Click the link below for a free consultation and free financial analysis.

You may schedule your time with us electronically here.

We look forward to visiting with you.

Sincerely,

Jeffrey Taxman, MBA

Principal

Physicians Financial Services

402.399.8820 (o) | 402.681.9007 (m)

402.397.9510 (f) | jtaxman@pfsfa.com

Online: www.pfsfa.com

Matthew Taub, JD

Associate

Physicians Financial Services

402.399.8820 x105 (o) | 531.375.5962 (d)

402.960.2571 (m) | mtaub@pfsfa.com

Online: www.pfsfa.com

Physicians Financial Services specializes in the unique financial needs of doctors and their families, as well as other productive individuals. A national practice, PFS has administrative offices in Omaha, Nebraska.

You Need Not Be a Doctor: we also work with other productive individuals with similar financial needs.

Further resources from Physicians Financial Services

Download our free E-book

A study of the economics of productive individuals’ lives focused on one question: what do you need to KNOW to succeed financially? A planning program was developed and a high percentage of those who implemented the planning recommendations ultimately achieved financial independence. DOWNLOAD E-BOOK>

Take the Loss Test

The Economic “Loss Test” is a diagnostic tool to assess your current financial structure, identifying opportunities. TAKE THE TEST>

Watch Our Webinar

The “Overflowing Buckets” guide to End Losses to Unnecessary Taxes and Risk. Based on the 50-year Doctors Economic Research Project. WATCH WEBINAR>

Schedule Your Meeting

An initial phone or zoom meeting can be scheduled electronically at no cost and with no obligation. SCHEDULE NOW>

We look forward to helping you.

Disclaimer

All information provided by Physicians Financial Services is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. Such information also is not and should not be deemed to be an offer to purchase or sell or a solicitation of an offer to purchase or sell, or a recommendation to purchase or sell any securities or other financial instruments. The content in this promotional literature is based on sources that are considered reliable. No guarantee is provided on its accuracy, correctness or completeness either express or implied. The information provided is purely of an indicative nature and is subject to change without notice at any time. The information provided does not confer any rights. The value of your investment may fluctuate. Results achieved in the past are no guarantee of future results. You must make your own independent decisions regarding any securities or other financial instruments mentioned herein. You are advised to seek professional advice as to the suitability or appropriateness of any products and their tax, accounting, legal or regulatory implications.

DOCTORS’ FINANCIAL EDUCATION. Financial Education Series. | © Copyright 2022 Physicians Financial Services. | Jeffrey L. Taxman, MBA, | PFS Consulting LLC | 1810 South 108th St., Omaha, NE 68144, jtaxman@pfsfa.com, 402.399.8820 (o), 402.397.9510 (f)