Inflation or recession?

And how to protect against both?

Is inflation ebbing, or here to stay? Is a recession fading from view, or just around the corner? Which should worry you more?

It’s a question that’s increasingly hard to ignore as these twin troubles loom over portfolios, pocketbooks, and long-term strategies to maximize wealth accumulation and achieve financial independence.

Inflation and recession are closely linked: to battle high prices, the Federal Reserve is raising interest rates, which could trigger an economic slowdown.

While a stronger dollar (the result of rising interest rates) makes your next trip to Europe easier on the wallet, clients are also looking for reliable assets that are immune to inflationary and market pressures. Beyond purchasing the $10,000 annual limit of inflation-protected bonds, they may try their hand in owning and renting real estate. But many are looking for institutionalized investments that pass on inflationary cost to end users (tenants) while removing their direct oversight or responsibility.

While Real Estate Investment Trusts (REITs) at times can be a good fit, they provide little relief from the volatility of the overall market and are not currently priced in an advantageous way. Delaware Statutory Trusts (DSTs) are an increasingly appealing option, and Qualified Opportunity Zones (QOZs) provide the additional benefit of a stepped-up cost basis (no tax on appreciation, provided the assets are held for ten years). Both DSTs and QOZs allow (but do not require) the deferral of capital gains taxes from the sale of an existing asset when investing in these structures.

Our clients have access to the authorities in institutional real estate and overall portfolio management. These assets are included in strategies that maximize contributions to defined benefit pension plans, captives, leveraged tax-free life income, and other structures that prevent unnecessary taxes and risk as part of comprehensive, integrated planning.

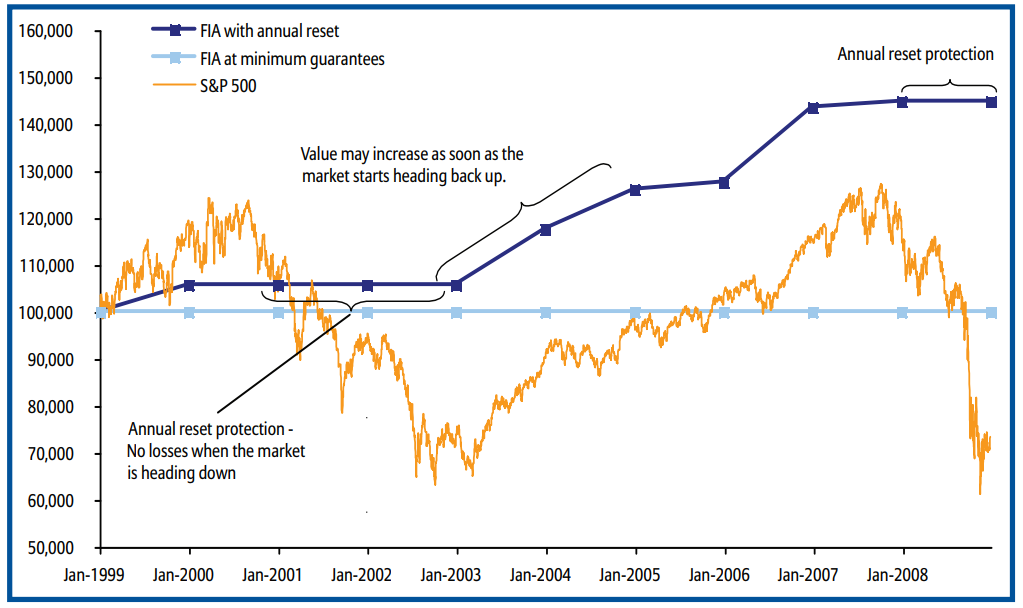

Equity Index Annuities as a proxy for bonds

The guarantees in our equity indexed annuities have prevented any losses during the downturn this year. Because the annuity does not require you to make up last year’s losses to create gains, we recommend substituting these instruments as a proxy for bonds. Our clients have access to a diversified portfolio of equity indexed strategies from legal reserve insurance companies.

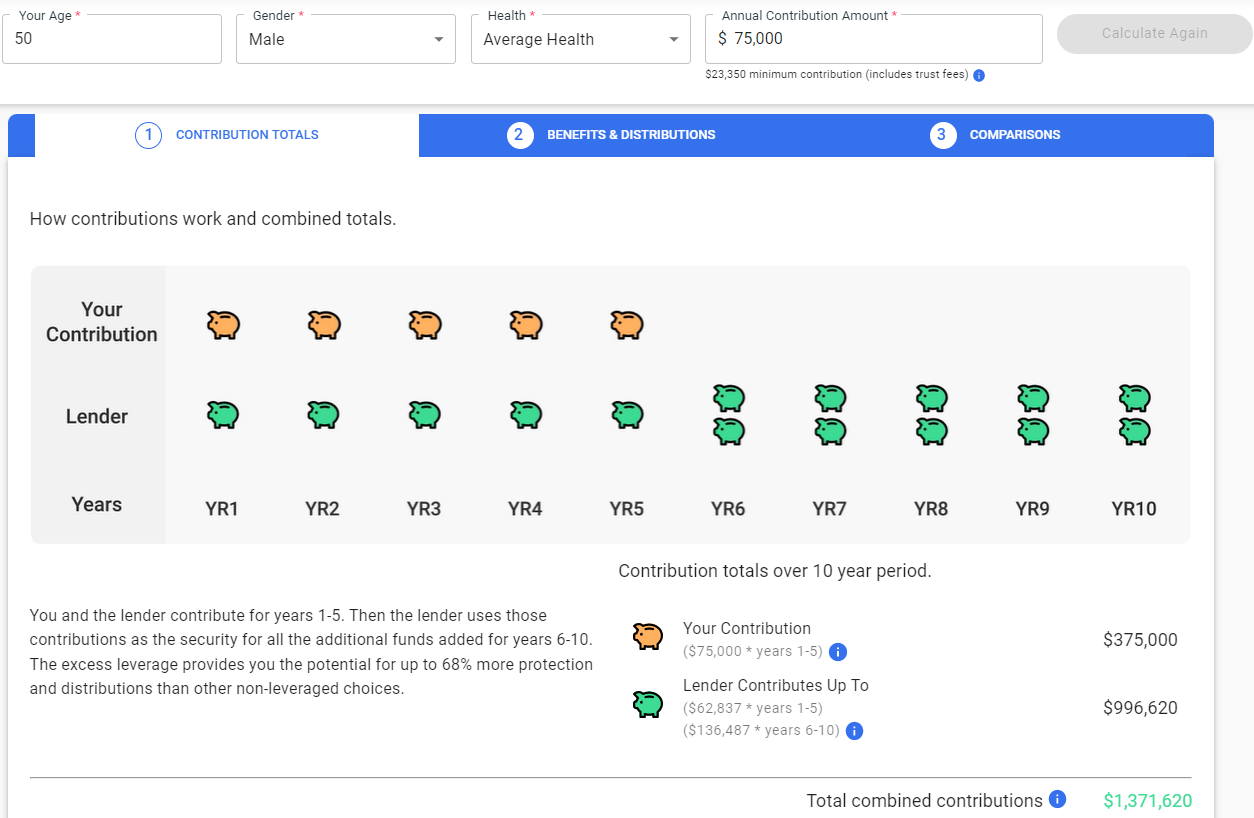

Leveraged Tax Free Life Income (LT-FLIP) custom illustrations available

Speaking of removing risk (and unnecessary taxes), the Leveraged Tax Free Life Income Program (LT-FLIP) generates 200% to 300% more spendable retirement distributions for half the cost in half the time. A bank or other lender contributes three quarters of the contributions, and is paid back from the growth of the policy later on. Customers can estimate their benefits based on their age, health, and annual contributions over 5 years.

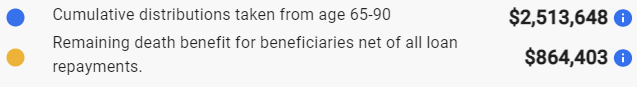

The LT-FLIP illustrations will show the projected accumulation available to spend, tax-free, in retirement:

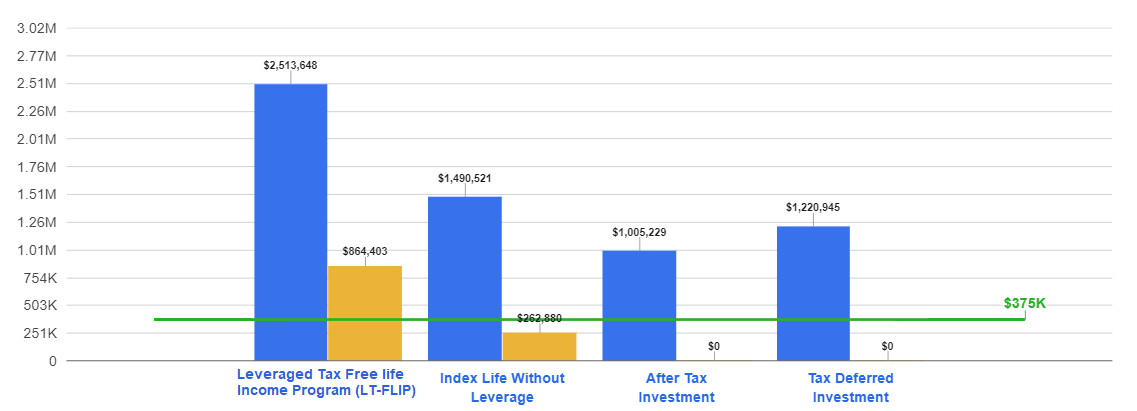

As well as a comparison to other investment vehicles with the client’s cash outlay as the benchmark ($375k in this case):

To run your own custom illustration, contact us for access.

Roth conversions to avoid future Required Minimum Distributions

A Roth conversion of qualified assets (money in a 401k or IRA, for example) is used to prevent future Required Minimum Distributions (RMDs) that lock in losses in a down market (as many retirees are currently experiencing). With likely passage of the SECURE Act “2.0” (currently passed in both chambers of Congress, but requiring reconciliation) raising the RMD age from 72 to 75, there will be an enlarged window of time to take action. There are no income limits on a Roth conversion and, while it does create a tax liability in the year it is executed, we are able to mitigate tax liabilities with charitable strategies that can provide advantageous benefits. Charitable projects of this nature vary from year to year. Contact us for more information.

Premium refund disability is back

Premium refund disability is back. That’s right–the premium you pay is refunded to you later on. We have two quality insurance companies writing non-cancellable, guaranteed renewable premium refund disability insurance covering your specialty in your practice to age 67. 80% of the premiums paid are refunded every 10 years.

We recommend funding with pre-tax dollars from the practice. We will include review of your disability income insurance (ideally covering 60% of your earnings) in our quarterly review sessions.

New associate; new digital presence

Matthew Taub, JD has joined Physicians Financial as an Associate. Matt has practiced law in New York and New Jersey and has worked in the financial industry for the last 7 years. He has experience providing financial planning to high income, high net worth clients, expertise in qualified plans, as well as the models of the Doctors Economic Research Project. As we do our review sessions with everyone this quarter, we look forward to introducing you to Matt. If you are a potential new client, we look forward to introducing you to both Matt and Jeffrey, as well our Office Manager / Executive Assistant, Alisa.

We also have a new web site, including a financial literacy resources page describing some of the strategies and structures to eliminate unnecessary losses of your earnings and savings. Additionally, we now have an eBook and webinar delineating our philosophy of moving doctors from less to more.

Meet with us

For over 30 years, our firm has helped successful physicians and dentists (as well as other productive individuals) across the country maximize the efficiency, control, and safety of the conversion of their earnings into spendable savings.

You can now schedule your initial consultation or client review meeting with us electronically.

We look forward to visiting with you.

Sincerely,

Jeffrey Taxman, MBA

Principal

Physicians Financial Services

402.399.8820 (o) | 402.681.9007 (m)

402.397.9510 (f) | jtaxman@pfsfa.com

Online: www.pfsfa.com

Matthew Taub, JD

Associate

Physicians Financial Services

402.399.8820 x105 (o) | 531.375.5962 (d)

402.960.2571 (m) | jtaxman@pfsfa.com

Online: www.pfsfa.com

Physicians Financial Services specializes in the unique financial needs of doctors and their families, as well as other productive individuals. A national practice, PFS has administrative offices in Omaha, Nebraska.

You Need Not Be a Doctor: we also work with other productive individuals with similar financial needs.

All information provided by Physicians Financial Services is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. Such information also is not and should not be deemed to be an offer to purchase or sell or a solicitation of an offer to purchase or sell, or a recommendation to purchase or sell any securities or other financial instruments. The content in this promotional literature is based on sources that are considered reliable. No guarantee is provided on its accuracy, correctness or completeness either express or implied. The information provided is purely of an indicative nature and is subject to change without notice at any time. The information provided does not confer any rights. The value of your investment may fluctuate. Results achieved in the past are no guarantee of future results. You must make your own independent decisions regarding any securities or other financial instruments mentioned herein. You are advised to seek professional advice as to the suitability or appropriateness of any products and their tax, accounting, legal or regulatory implications.

DOCTORS’ FINANCIAL EDUCATION. Financial Education Series. | © Copyright 2022 Physicians Financial Services. | Jeffrey L. Taxman, MBA, | PFS Consulting LLC | 1810 South 108th St., Omaha, NE 68144, jtaxman@pfsfa.com, 402.399.8820 (o), 402.397.9510 (f)